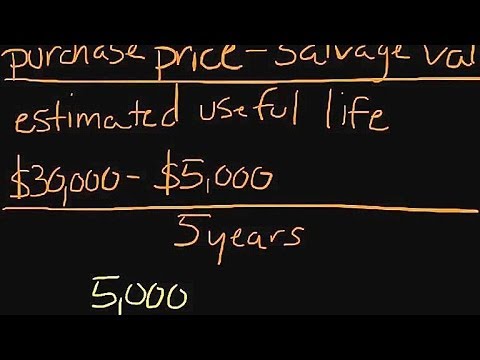

Well, over the course of this brief video, I'm going to show you how to calculate depreciation utilizing the straight-line method. There are several different alternatives for how to calculate depreciation. The straight-line method is by far the most simplistic and easiest to do, but it's also fairly common. Although you do see companies utilize different methods on different levels. So, the reason that we calculate depreciation first, obviously, is because of accounting. We know that we can't necessarily claim the value of an asset as the same over a period of time. For example, if we purchase something like a company vehicle and say we purchase it for $20,000 right off the lot, we know that over time that vehicle will not be worth the same that it was when we purchased it. Not only is it going to accrue mileage, but there's going to be additional wear and tear that is going to make it worth less. And so, for assets, we depreciate those because we know that they lose value over time. Same thing with equipment like laptops and different things. They begin to deteriorate over time, so we can't claim the value of those as assets on our balance sheets. So, how do we go ahead and do this? There's a basic equation for how to calculate depreciation utilizing the straight-line method. The first thing that we need to know is the purchase price of that particular asset. So, this is the amount that we actually purchased it for, and then what we need to do is we need to determine a salvage value, and so we factor out what's called a salvage value, and I'll explain more about what that is. And then what we do is we divide that by what we call our...

Award-winning PDF software

4562 example 2025 Form: What You Should Know

What Is the IRS Form 4562? — Turbo Tax Tax Tips & Videos Jan 24, 2025 — If you're electing to expense certain property under What Is the IRS Form 4562? — Turbo Tax Tax Tips & Videos You can deduct your depreciation in one of three ways under IRS form 4562: A. Amortize using either your investment earnings from the property or the sale price (if the property is a depreciable asset in the year of purchase), or B. Use the cost basis, which is the date the property was bought (but you can deduct the basis when the property is used). C. Use the total depreciable basis, which is everything you've depreciated or amortized, or D. You can depreciate property as long as you're able to use it. The IRS can assess a penalty of 20% for understatements in the capitalized cost or cost rate in this section. The IRS also has a special rule which allows you to report a reduced capital expense deduction. The reduced capital cost deduction is a deduction that is limited to 100,000 of the capital expense (150,000 if you're a partnership), including any related interest expense (other than the interest on any loan you made). Capital cost or cost basis can also be reported in a separate return under section 263A. A reduced capital cost deduction allows the same exclusion, exclusion, deduction, or reduction as a straight line rate adjustment under section 1245. Do not include in gross income the depreciable value of property placed in service at a price equal to or less than the amount you depreciated, or the gross amount of interest paid on borrowed money at an interest rates above that allowable under the Internal Revenue Code. Example — Underlying Costs. The depreciable basis of your business property is 10 million for the 2025 tax year. You depreciated 3 million of the property (3 million x 1.8 times the number of calendar years you had owned your depreciable property) during the year and paid 500,000 of interest on a 5 million loan at rates above that allowable under the Internal Revenue Code. Therefore, your income before subtracting deductions is 2 million for the year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4562, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4562 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4562 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4562 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4562 example 2025